Get to grips with your pension this year

Now could be the perfect time to do the pension admin tasks you have been putting off.

“Advertising Feature”

The new year is a chance to refresh and make plans to improve your retirement prospects. Here are six suggestions to get you started.

- Track down any lost pensions

If you have moved jobs frequently, or your address has changed, you may have pensions that you have lost track of. Research suggests there are around 1.6 million unclaimed pots worth £19.4 billion – the equivalent of nearly £13,000 per pot.1

Tracking down a lost pension can be as simple as making sure any old pension providers have a current address for you. If you have recently moved house, you should write to the pension company, tell them your new address and ask for a statement.

If you’re trying to track down a lost workplace pension, you could try contacting the company you used to work for. However, you may find that your old employer doesn’t exist anymore, or you’re trying to trace an old personal pension and you don’t have any contact details. In this case, you can get help from the government-backed Pension Tracing Service, either online or by calling 0800 731 0193.

- Consider consolidating

If you have several pension pots, it may be a good idea to combine them into one pot.

This could:

- Help you to avoid dealing with multiple providers.

- Make it easier to keep track of your overall savings and estimated income at retirement.

- Open up a greater choice of investments.

- Make it easier to diversify and switch your investments.

Bear in mind that some pensions have high exit fees or include guaranteed annuity rates which may be lost, so it’s important to understand the risks of transferring out of your scheme before proceeding. This is where professional financial advice will really help.

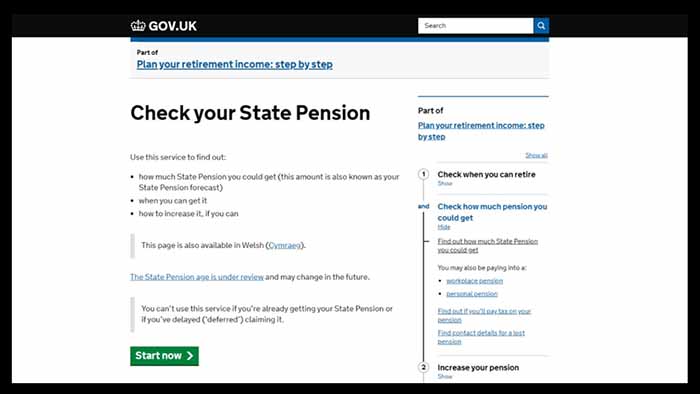

- Check your State Pension

It’s very hard to plan your retirement without a full view of your State Pension. It’s, therefore, a good idea to check how much State Pension you could get and when you could get it. You can do this online at www.gov.uk/check-state-pension.

You will also be able to see your National Insurance record, and whether you can improve it. You might be able to fill gaps by claiming National Insurance credits or making voluntary National Insurance contributions.

It’s very hard to plan your retirement without a full view of your State Pension.

- See if you can pay in more

Pension policy is an area that has been neglected since the Brexit referendum result, so it’s possible the government will announce a review of pension taxation in the Budget on 11 March. Therefore, if you’ve still got a few years to go before retirement, think about boosting your personal pension now so that you can benefit from current rates of tax relief and potentially enjoy a higher income when you stop work.

If you have surplus cash that is not earmarked for other purposes and you haven’t used all your 2019/20 pension allowances, making a one-off pension contribution can be a smart way to get nearer that retirement goal.

- Check your investments

Ensuring that your retirement fund is appropriately invested and sufficiently diversified is crucial. Therefore, asset allocation should be reviewed regularly to ensure it still reflects your attitude to risk.

Portfolios have a tendency to deviate from the initial weightings over time. For example, more volatile assets can perform better over the longer term and therefore make up an increasing proportion of the overall portfolio. This can make your portfolio unbalanced and riskier than initially intended.

A financial adviser can rebalance your investment portfolio and get your target asset allocation back on track. They can also help to ensure your financial plan remains appropriate and is on course to achieve its goals.

- Nominate beneficiaries

Most pension schemes allow anyone to inherit your pension savings – they don’t have to be your spouse or civil partner. There’s no limit to the number of people you can nominate.

Passing on pensions is done through completion of an ‘expression of wish’ form. This tells the trustees of the pension scheme to whom they should pay death benefits. It’s important to keep this updated, ideally at least annually, but also when either your own circumstances or those of your proposed beneficiaries change.

The new year could be an ideal time to get this form updated. If you need any help completing it, speak with your financial adviser.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are dependent on individual circumstances.

1 The Pensions Policy Institute, October 2018.

Mark Lowe Wealth Management

Address: First Floor, 1 Mossley Road, Grasscroft, Oldham, OL4 4HH

Office Number: 0161 338 4659

Mobile Number: 07779 725562

Email: Mark.lowe@sjpp.co.uk

Website: www.marklowewm.co.uk

The Partner Practice is an Appointed Representative of and represents only St. James’s Place Wealth Management plc (which is authorised and regulated by the Financial Conduct Authority) for the purpose of advising solely on the group’s wealth management products and services, more details of which are set out on the group’s website www.sjp.co.uk/products. The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives.

For more financial advice visit: https://aroundsaddleworth.co.uk/category/business/